Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

The Sarbanes-Oxley Act (or SOX Act) is a U.S. federal law that aims to protect investors by making corporate disclosures more reliable and accurate. The Act was spurred by major accounting scandals, such as Enron and WorldCom (today called MCI Inc.), that tricked investors and inflated stock prices. Spearheaded by Senator Paul Sarbanes and Representative Michael Oxley, the Act was signed into law by President George W. Bush on July 30, 2002.

The SOX Act consists of eleven elements (or sections). The following are the most important sections of the Act:

Financial reports and statements must certify that:

Financial statements are required to be accurate. Financial statements should also represent any off-balance liabilities, transactions, or obligations.

Companies must publish a detailed statement in their annual reports explaining the structure of internal controls used. The information must also be made available regarding the procedures used for financial reporting. The statement should also assess the effectiveness of the internal controls and reporting procedures.

The accounting firm auditing the statements must also assess the internal controls and reporting procedures as part of the audit process.

Companies are required to urgently disclose drastic changes in their financial position or operations, including acquisitions, divestments, and major personnel departures. The changes are to be presented in clear, unambiguous terms.

Section 802 outlines the following penalties:

After the implementation of the Sarbanes-Oxley act, financial crime and accounting fraud became much less widespread than before. Organizations were deterred from attempting to overstate key figures such as revenues and net income. The cost of getting caught by the United States Securities and Exchange Commission (SEC) had exceeded the potential benefit that could result from taking liberties with the way that financial documents were presented.

Thus, investors benefited from access to more complete and reliable information and were able to base their investment analyses on more representative numbers.

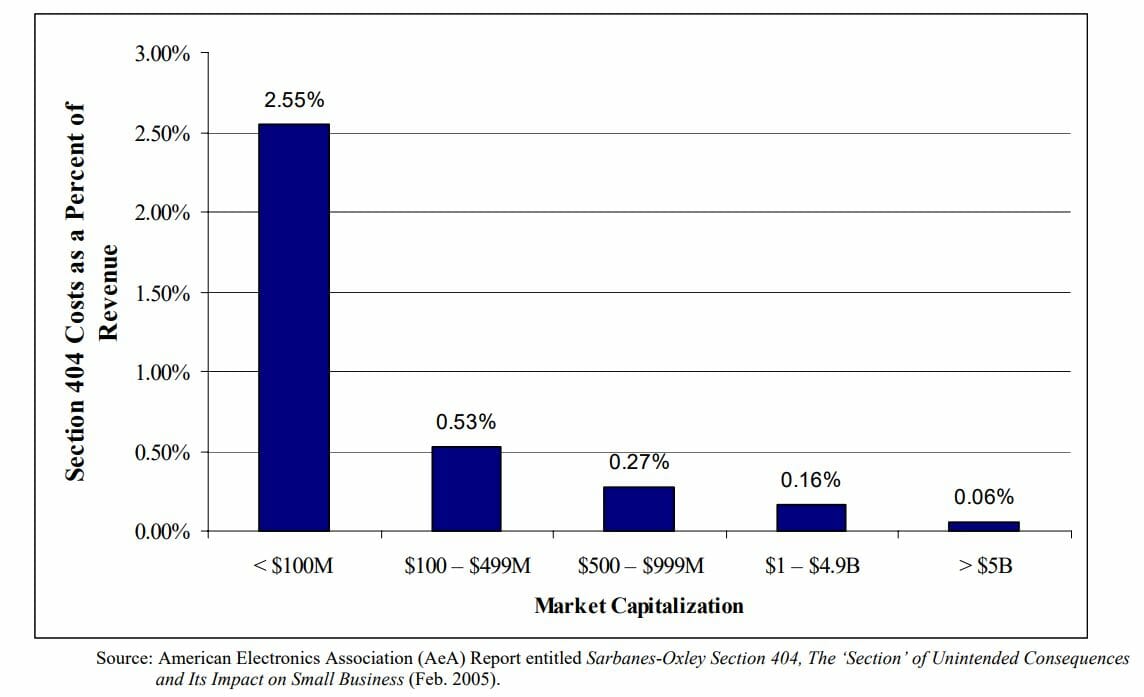

While the Sarbanes-Oxley act benefited investors, compliance costs rose for small businesses. According to a 2006 SEC report, smaller businesses with a market cap of less than $100 million faced compliance costs averaging 2.55% of revenues, whereas larger businesses only paid an average of 0.06% of revenue. The increased cost burden was mostly carried by newer companies that had recently gone public. A more granular view of the compliance costs experienced by businesses can be found in the chart below:

Due to the additional cash and time costs of complying with the Sarbanes-Oxley Act, many companies tend to put off going public until much later. This leads to a rise in debt financing and venture capital investments for smaller companies who cannot afford to comply with the act. The act faced criticism for stifling the U.S. economy, as the Hong Kong Stock Exchange surpassed the New York Stock Exchange as the world’s leading trading platform for three consecutive years.

CFI is the official provider of the global Financial Modeling & Valuation Analyst certification program, designed to help anyone become a world-class financial analyst. The following CFI resources will be helpful in furthering your financial education:

Become a certified Financial Modeling and Valuation Analyst (FMVA)® by completing CFI’s online financial modeling classes!